After taking my family on a nine-day vacation to Honolulu, Hawaii, my plan to relocate there is back in the cards! Since 2014, two years after retiring from my finance job, I’ve been contemplating moving back to Honolulu to spend more time with my parents. However, actually making the move has been much harder than expected.

Just as financially insecure people often tell themselves “just one more year” before retiring, I’ve been saying “maybe next year” about moving to Honolulu for the past 10 years!

The thing is, life keeps getting in the way. First, we had a son in 2017, then a daughter in 2019, and the pandemic made us crave stability and familiarity. Our son got into a school he enjoys immensely, and now our daughter has joined the same school, which we believe she’ll also enjoy. As a result, the inertia of life has kept us in San Francisco.

However, with my parents now in their mid-70s, the time to spend more time with them is now. Our kids also handled their longest time away from home well. Although, they complained about the heat, they missed it once we returned. My concerns about them adjusting to a new environment have diminished.

For background, my grandparents were born and raised in Honolulu, so was my dad. My grandmother is half native Hawaiian as well. Both my parents are retired in Honolulu.

The Challenges of Living in Honolulu, Hawaii

There are three main challenges of living in Honolulu: housing, food, and work. If you plan to send your children to private school, affording the tuition and getting accepted are also significant challenges.

Let’s discuss each challenge if you’re considering living and working in Honolulu. If you have ever lived and worked in Honolulu or currently do, I’d love your insights as well.

Honolulu’s High Home Prices

Honolulu boasts one of the highest median home prices in the nation at roughly $1,050,000. Meanwhile, Zillow has the median Honolulu home price around $800,000, but I don’t trust Zillow. When house hunting, it often seems that homes cost much more than the median price, no matter the city. Funny how that is.

To afford a median-priced home using my 30/30/3-5 home buying rule, you’d need to make between $210,000 and $350,000, have a $210,000 down payment, and maintain a $105,000 liquid buffer post-purchase.

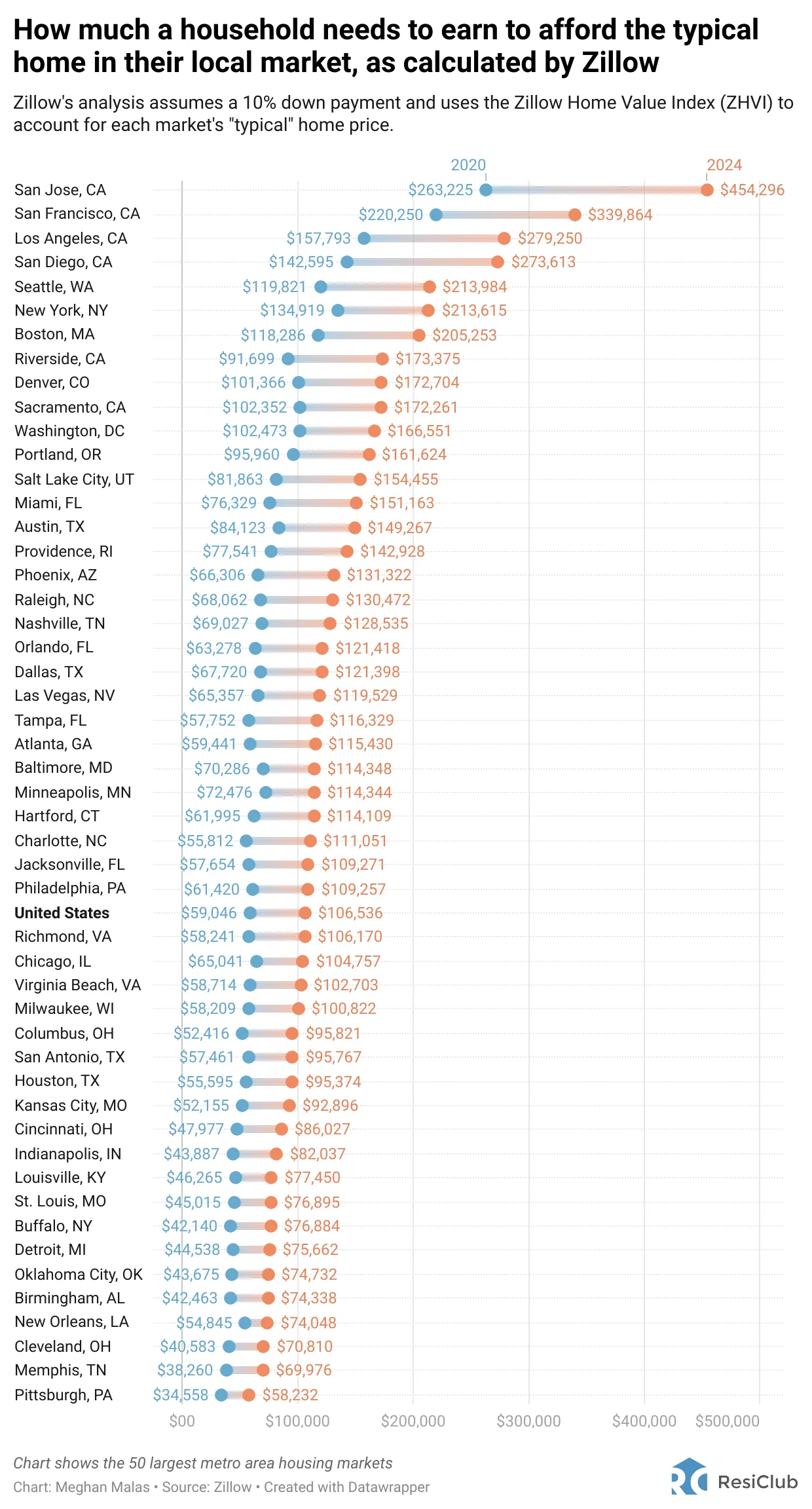

If you come from high-priced housing markets like San Jose, San Francisco, Los Angeles, San Diego, Seattle, New York, or Boston, you might not be as shocked by Honolulu’s high home prices. However, if you’re coming from everywhere else in America, prepare to feel the pain.

Owning Real Estate in San Francisco Makes Moving To Honolulu Easier

The median home price in San Francisco is around $1,800,000, which is about 75% higher than in Honolulu. Therefore, moving to Honolulu could save us around 40% if we buy a median-priced home.

However, we don’t want a median-priced home; we want a fantastic home with ocean views or one that is remodeled and close to the beach. Unfortunately, these homes cost over $4 million, with really no upper limit.

To pay for such a home with cash, we’d need to sell several rental properties. This would simplify our lives as we age, but it would also hurt our passive income again. After cutting our passive income by ~29% in 2023 due to a cash home purchase, we don’t want to make such a drastic move again.

Luxury homes in Honolulu often take 3 – 6 months to sell, unlike in San Francisco, where selling in one month is common. Given the fewer high-paying jobs in Honolulu, there’s a greater investment risk associated with buying luxury real estate there.

If you buy property in Honolulu it’s best to think of the house more as a consumption expense than as an investment.

Honolulu’s High Food Costs

Produce in Honolulu is the most expensive in America due to the extra shipping costs. For example, a bag of cotton candy grapes I bought costs $18 at Safeway in Honolulu, compared to $14 in San Francisco.

Expect to pay $20 – $25 for a plate lunch, making it easy for a family of four to spend $80 – $100 for lunch, including tax, tip, and drinks. However, portion sizes are relatively large when dining out, including food trucks.

Below highlights a variety of food costs in Honolulu, updated at least once a year by a community of travelers. No matter where you come from, you will definitely feel the burden of high food costs in Honolulu.

We Grow Our Own Fruit in Honolulu

In Hawaiian culture, there’s a saying: “If you take care of the land, the land will take care of you.” Thanks to the trees my grandparents and parents planted decades ago, we have plenty of fruit in our backyards.

We have several mango trees that produce over 500 mangoes a year. By relocating to Honolulu, my family of four will ensure these mangoes don’t go to waste. We also have guava, orange, and pomelo trees, which means we won’t need to spend much on breakfast if we keep to a mostly fruit morning diet.

During our trip, our family of four mostly shared two plate lunches and had leftovers. Most of the reason is because our children are still young. However, my wife and I have always been moderate eaters and are only about 5% heavier than we were since college.

Honolulu’s Relatively Low Pay

The most common feedback from locals is the lower pay compared to the mainland. We’re talking 40%-60% lower pay for the same jobs. There are also fewer six-figure jobs available, especially compared to San Francisco’s tech sector. The main industries in Honolulu are tourism, defense, agriculture, fishing, and manufacturing, which aren’t known to be high-paying industries.

According to the 2020 Census, the median household income in Honolulu was $96,580. The St. Louis Fed data shows it was $96,304 in 2022. For 2024, the household income is likely closer to $105,000 – $110,000.

While not bad in a vacuum, it’s not great compared to the median home price of $1,050,000. Consequently, it’s common for two or three generations to live together. If a household consists of two-to-four working individuals, a median household income of $100,000 isn’t high.

As of May 2024, ZipRecruiter reports the average salary in Honolulu is $61,247. To own a median-priced house and raise a family in Honolulu, you need to earn far above average or cohabitate with multiple working individuals. The financial support of parents is also quite common.

We Have Enough Passive Income For Living In Hawaii

After saving and investing since 1999, we have enough passive income to support a middle-class lifestyle for a family of four in Honolulu since it’s cheaper than San Francisco. The key is to keep our housing costs lower than they are in San Francisco. If we want to buy a luxury property, we may need to work part-time or full-time.

However, going back to work is something I look forward to because I want to be a teacher at my children’s school. Relocating to a new city means making new friends and meeting new people, and diving headfirst into my children’s school community is an ideal way to do that.

As a teacher, I’ll get to know many other teachers and administrators, as well as plenty of new parents. I’d love to teach personal finance, entrepreneurship, marketing, branding, and communications to middle or high school students. I spent three years coaching high school tennis and enjoyed it for the most part.

If I can’t get a job teaching at my children’s schools, I’ll continue to write from home. But instead of slowly going crazy writing in a dark room, I’ll get to write outside on a lanai overlooking the water!

If my next two books do well (scheduled for 2025 and 2028), maybe I’ll get another book deal that keeps me writing until both kids graduate high school. The pay isn’t high as an author, but writing books will show them their old man takes academics seriously.

Honolulu’s Independent Grade Schools

Honolulu has some excellent independent and public schools. Since our kids already attend a Mandarin immersion independent school, we plan to continue with independent education initially.

My parents live near two of Honolulu’s best independent grade schools: ‘Iolani and Punahou. We toured ‘Iolani and Punahou with our children, and found both schools to be amazing incredible facilities. Maryknoll also offers a Mandarin immersion program, which is attractive if we relocate while our kids are still young. We highly value learning a second language.

As a bonus, the annual tuition at ‘Iolani and Punahou is about $13,500 less than what we pay in San Francisco, and Maryknoll is $23,000 cheaper. The tuition is also the same from K-12, so if we move when our kids are older, we’d pay about 50% less since prices go up by grade in San Francisco.

The combination of better facilities and lower costs is hard to beat. I’m sure the teachers are wonderful too. However, getting into these schools will be challenging without a local network to support us.

Iolani’s main entry points are Kindergarten and 6th grade, while Punahou has entry points at K, 4, 6, 7, and 9.

The difficulty will be in getting into schools

If our experience with applying to preschool in San Francisco is any indication, getting both kids into such independent schools will also be difficult. Demand is always high, and we are coming from San Francisco, where we don’t have a local Honolulu network to support us.

It’s possible that one of our kids gets in and the other doesn’t. Logistically, having two kids go to different schools is suboptimal. Punahou has more accommodative entry points with K, 4, 6, 7, and 9. Given our kids are three years apart, entry for grades 4 and 7 or 6 and 9 would work.

We hope my background now as an author provides variety from other families who are mostly in medicine, law, and finance. We also don’t need tuition assistance for two kids and can regularly donate.

Based on the ages of our kids and the schools’ main entry points, we would apply in the Fall of 2029 for our daughter to enter as a 4th grader and our son to enter as a 7th grader at Punahou in 2030. Or we can apply in the Fall of 2031 for 6th grade and 9th grade in 2032.

Relocating to Honolulu in 2032 is probably best because our children will learn more Mandarin at their school, which goes until the 8th grade. We’ll get to enjoy our San Francisco home we just bought in 2023 for nine years.

The Fear Of Being A Stranger In A New City Is Overblown

You might fear relocating because you’ll have to start over making friends. The stronger your friendships and family connections back home, the harder it is to move.

However, as a school parent, I’ve realized how easy it is to meet new people and make friends if you want to. There are endless social functions to meet other parents, including playdates, birthdays, school events, parents’ nights out, and fundraisers.

In addition, you can join meetups or clubs related to your hobbies. My private sports club in San Francisco has provided the biggest lifestyle boost for only $175 a month. It’s been a great way to meet fellow tennis and pickleball players.

So don’t be afraid of loneliness when relocating. Honolulu has warm and welcoming residents. Just make sure to understand the culture, familiarize yourself with Hawaiian language, and respect island traditions. As a new resident, try to give more than you take.

As for the kids, it’s better if they relocate to a new city when they were younger. It will be tough to leave their friends in SF, but they will make new friends. Besides, their school only goes to the eighth grade, which means they eventually have to reapply anyway.

Selling Property Before Relocating To Honolulu

We’ve been accumulating properties in San Francisco since 2003. We now have four rental properties and one primary residence in San Francisco, plus a vacation property in Palisades Lake Tahoe. Our net worth is getting complicated and we wouldn’t mind simplifying.

Given we need capital to buy a new home and don’t want to deal with tenant and maintenance issues, we probably need to sell at least two properties before we relocate. Currently, I manage all properties in San Francisco, which is easy and gives me something to do.

With real estate commissions coming down after the NAR price-fixing settlement, selling now has become more palatable. I just can’t get myself to pay more than a 4.5% selling commission rate when technology has lowered commissions in every other industry.

At the same time, with the tech and artificial intelligence boom, selling now is hard. I expect AI to boost housing prices in the San Francisco Bay Area decades to come. Besides investing in private AI companies, the next best way to participate in AI is by owning real estate in cities with the leading AI companies.

In 20 years, I’m sure I will look back with regret having sold a prime west side San Francisco property today. Therefore, I would like to maintain at least two investment properties in San Francisco if we relocate. Maybe a property manager is the solution, but I’m not sure.

It’s Worth Living In The Best Place Possible

I’ve lived abroad for 13 years in five countries, worked in international equities for 13 years, and traveled all over America for the past 47 years. Honolulu is one of the best places to live in the second half of your life.

There’s a reason why Hawaii residents have the longest life expectancy in America: a better, more relaxing lifestyle. Once you’ve accumulated enough wealth, having a long and healthy life becomes a priority.

Yes, there are downsides to living in Honolulu, such as traffic, higher prices, relatively high state income taxes, and island fever. It will also be tougher “making it in Hawaii” unless you’re in medicine, law, or an entrepreneur. Even then, it’s tough to grind so hard when island life is so relaxing. Finally, the pace of life is much slower, which can also be hard to adjust to.

However, I believe the positives far outweigh the negatives. Once you’ve built enough wealth, your goal should be to live as long and as healthy a life as possible.

Winding Down In Honolulu In The Second Half Of Life

I want to wear shorts and t-shirts year-round. It would be nice to swim in the ocean in the mornings and play tennis in the evenings. Living in a medium-sized city also provides enough work opportunities to stay productive, but not so much that you feel overwhelmed by competition. Most of all, I want my family to be safe and happy.

Honolulu provides all these things. However, we won’t know until we try to relocate in 2030 at the earliest. Ideally, we relocate in 2032 when our son is in 9th grade and our daughter is in 6th grade. This timeline will maximize our time in our new house, benefit from the AI boom, and give us time to space out the sale of our properties.

In the meantime, we will be sending our kids to summer school in Honolulu for at least a month so we can try before we buy!

If you live and work in Honolulu, I’d love to hear your thoughts! What are some other negatives and positives we should know about before relocating?

Don’t Quit Your Job To Relocate To Honolulu

If you’re planning to leave your job for a new one in Honolulu, I’d try and negotiate a severance package instead of quitting. You will appreciate the financial runway given pay is often lower in Honolulu.

Check out How To Engineer Your Layoff, the best resource to teach you how to negotiate a severance package. Use “saveten” at checkout to save $10. I’ve updated the book six times with new strategies and insights since 2012.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009.